Why UHC's Extender Discount Is So Unfair For Pediatric Practices.

Why UHC's Extender Discount Is So Unfair For Pediatric Practices.

15% Off Pediatric Care: MCOs' 'Special' Way Of Saying Thanks For All The Checkups!

Paul D. Vanchiere, MBA

Founder & Principal Consultant for PMI

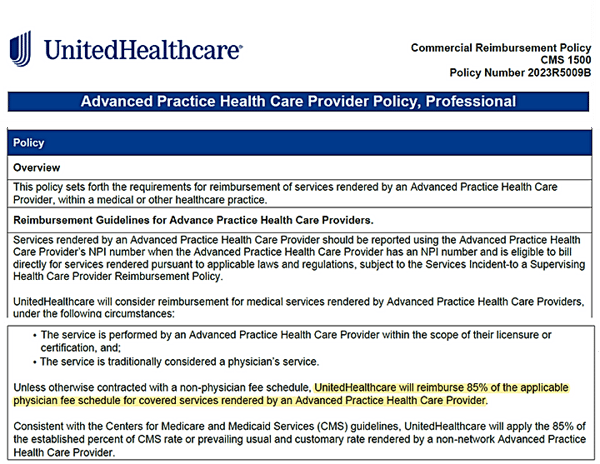

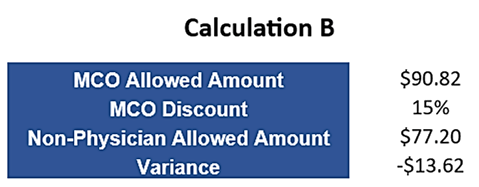

Pediatric practices continue to tussle with Managed Care Organizations (MCOs) as they, along with several Medicaid programs, continue their efforts to reduce payments for services provided by "Advanced Practice Health Care Providers" such as nurse practitioners and physician assistants. With the anticipated rise in the number of non-physician providers providing care for children in the upcoming years, there is growing concern that these payment policies will threaten the financial well-being of pediatric practices across the United States. For example, United Healthcare's prevalent national policy, which is frequently cited during payment negotiations them, clearly indicates their intention to deduct 15% from their agreed-upon rate for services offered by non-physicians.

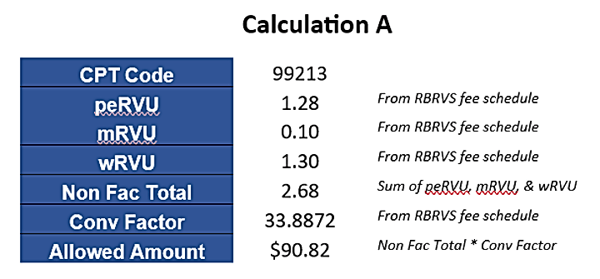

*In the interest of simplicity, no GPCI adjustments are being applied in this example.

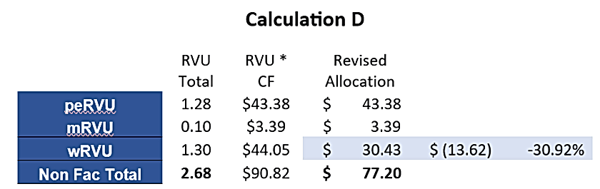

In truth, when adhering to a Medicare-based fee schedule, payors overlook the fact that a CPT code consists of three distinct elements to address the provider's education & training (wRVU), the practice's operating expense (peRVU), and the estimated cost associated with medical malpractice (mRVU). Applying a flat discount for non-physicians broadly across all three elements of a single CPT code contradicts the underlying premise the MCO's and certain Medicaid plans use to justify the reduction in payment- which is the claim that non-physician providers are less trained with lower compensation costs. While such claims could be debated, payors conveniently overlook that the practice expense and estimated medical malpractice costs remain consistent for the services provided regardless of the type of provider tending to the child's healthcare needs.

As such, shouldn't a payor's 15% discount be applied exclusively to the wRVU component of the CPT code? If MCOs and Medicaid plans persist in imposing the 15% discount across all three components of a CPT code, they are applying faulty logic to their fee schedule that is, in fact, contradictory to the payor’s stated reasoning for the reduction in payment.

Logically, the payor should apply the 15% discount only to the work component, rather than all three RVU components for a specific CPT code. If the MCOs were to restrict the 15% reduction to just the work component, the overall non-facility RVU total for 99213 would shift from 2.68 to 2.49:

As one can see, after applying the 2023 conversion factor of 33.8872 to the “Discounted RVUs” in Calculation C, the discounted allowed amount for non-physicians providing 99213 services should be $84.38 versus the $77.197 as illustrated in Calculation B where the payor is applying the discount across all three components.

The most concerning measures implemented by MCO and Medicaid plans are their application of discounts for non-physicians when billing CPT codes that lack work values. The RVS Update Committee (RUC) plays an advisory role to Medicare, suggesting suitable values for each CPT code. After thorough analysis, the RUC has identified numerous CPT codes where no work value is deemed necessary. Essentially, this signifies that certain CPT codes, like vaccines, various radiology/laboratory codes, and others, do not demand specialized medical training to deliver value during patient interactions. Basically, CPT codes without work values are more along the lines of technical procedures than actions taken by a provider that requires education and training. Specifically, the RUC has identified codes 96110 (Developmental screen w/score) and 96127 (Brief emotional/behavioral assessment) as lacking associated work values. Given this, how can payors defend their discounts for services rendered by non-physicians, unless their intent is simply cost-cutting? Especially when the remaining components (peRVU and mRVU) remain constant, irrespective of the service provider type.

Diving deeper into this, if we attribute the full $13.62 discount for 99213 shown in Calculation B solely to the work component, and keep the practice expense and malpractice values constant, the amount designated for work drops from $44.05 to $30.43. This difference of $13.62 in the work component equates to a payment decrease of 30.92% for the provider's services, contrasting sharply with the originally proposed 15% discount policy:

Admittedly, many payors assert that they utilize their own “proprietary fee schedule” rather than a defined Medicare-based fee schedule. However, the underlying foundation for most MCO fee schedules is undoubtedly the Medicare Resourced-Based Relative Value Scale (RBRVS) system. This can be evidenced by examining two specific codes, 99213 and 99214. In 2023, the total non-facility RVUs for these codes are 2.68 and 3.79, respectively, with a difference of 1.11, or roughly 40%. This difference between the two codes has remained consistent over the past decade. To validate the true basis of an MCO "proprietary fee schedule" presented for a practice's consideration, one only needs to compare the payment difference for 99213 and 99214. If the disparity is within the 40-50% range, it confirms that the MCO fee schedule draws its origin from the Medicare RBRVS system, regardless of the payor's claims.

Introduced in 1989, the RBRVS system, while not without some flaws, has been the cornerstone for a significant portion of payment agreements with physicians for patient care services. Regrettably, there's scant evidence suggesting that the application of a payor's “proprietary fee schedule" versus a percentage of a particular year's Medicare rates has ever been advantageous to pediatric practices.

Instead of fully embracing a well-recognized model to determine reasonable and fair payment rates, MCOs and Medicaid plans often selectively adopt components of the RBRVS system that primarily benefit their own financial interests.

As payors increasingly push for discounts for services rendered to children by non-physician providers, practices employing such professionals need to grasp the implications of such actions and be ready to figure out how to accurately allocate the revenue non-physician providers produce in order to properly align their compensation packages. It is crucial for practices to understand the potential ramifications of allowing payors to apply such discounts to every component of a particular CPT code versus the specific component they claim to be addressing. In the longer perspective, if payors are successful in continuing to nickel and dime the practices in such a manner, there will be a gradual erosion of the financial stability of pediatric practices employing non-physician providers in the forthcoming years- which does not help in any way the medical community's efforts to provide the medical home for children they so rightfully deserve.

CPT codes, descriptions and other data only are copyright 1995 - 2023 American Medical Association. All rights reserved. CPT is a registered trademark of the American Medical Association (AMA).