Succession Planning & Valuations For Pediatrics

PMI founder and lead consultant Paul Vanchiere addresses the vital topic of ensuring the long-term sustainability and success of pediatric practices. This session explores the intricacies of succession planning, from identifying potential successors within the practice, to understanding the various transition options available, including selling the practice, merging with other healthcare entities, or passing it on to the next generation.

Attendees will gain valuable insights into the financial, legal, and operational aspects of succession planning, enabling them to make informed decisions about the future of their practices. By attending this presentation, attendees can proactively prepare for the eventual transition of their practices, ensuring a smooth handover that preserves their legacy and maintains the continuity of care for their patients.

Let's Make Life Easier

There are many moving and interconnected parts when it comes to succession planning. Exploring and analyzing the culture of the practice, provider compensation models, and divvying of the profits requires an intimate understanding of the nuances of a pediatric practice.

Schedule Your Complimentary Succession Planning Consultation

Plan for the Future

No matter how healthy a pediatrician may feel today, the reality is that every last one will leave the practice at some point in the future. For pediatricians who have conventional expectations that they will be at the practice until they retire or life throws a curveball with unexpected reasons to leave the practice before retirement, it is imperative that your practice have a well-thought-out plan to align expectations on what will happen when an owner departs.

Succession Options Available For Your Practice

-

This involves an "internal" buy-in or buy-out scenario where a pediatrician becomes a new partner/shareholder in the practice or an existing pediatrician wishes to retire and sell their interest in the practice to the remaining partners/shareholders.

-

Valuations in such cases generally tend to be lower compared to those offered by private equity-backed investments. Various factors come into play, including the practice's cultural expectations regarding profits and their distribution of profits.

-

These organizations have actively pursued opportunities to acquire pediatric practices in recent years.

-

Private equity-backed firms have their own set of advantages and disadvantages, and careful evaluation on a case-by-case basis is crucial to ensure compatibility with the practice's culture and expected future financial performance.

-

Valuations in these situations focus on Earnings Before Interest, Taxes, & Amortization (EBITA), often resulting in higher pediatric practice valuations thanks to commonly accepted financial models. For instance, if a practice's estimated EBITA is $200,000, a private equity-backed firm may be willing to pay several multiples of that amount, potentially ranging from 5 to 7 times EBITDA, or even higher in rare cases.

-

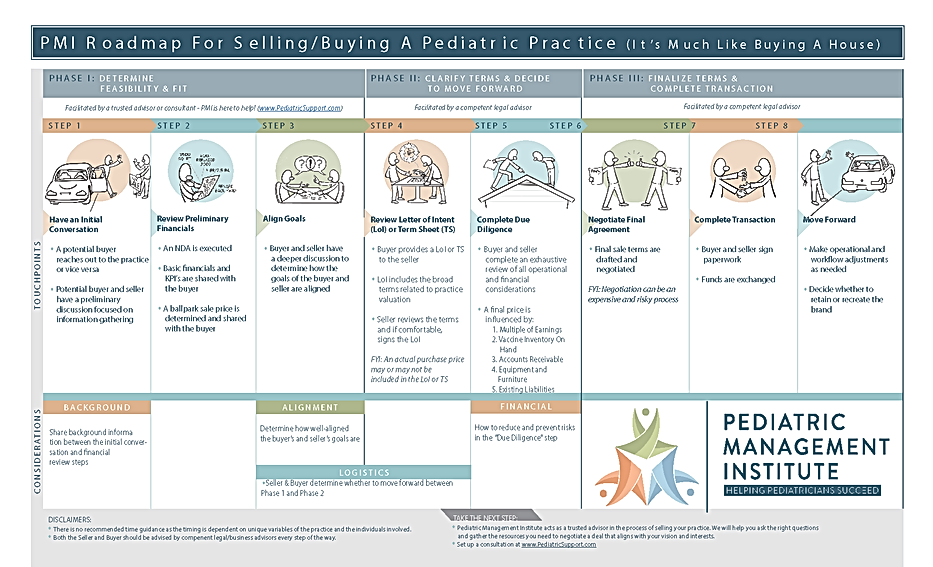

Additional complexities arise with private equity-backed investments, such as long-term plans, future employment contracts, non-compete covenants, and operational issues. PMI's published "Roadmap For Buying/Selling A Pediatric Practice" is recommended as a resource to help practices navigate such opportunities effectively.

-

Hospitals are no longer as willing to pay substantial amounts to acquire practices due to concerns regarding the costs outweighing the revenue from referrals.

-

Except for innovative joint-venture arrangements, hospitals are limited by Federal Stark laws, which restrict the amount they can pay to avoid any appearance of inducing referrals to the hospital's services.

-

Similar to private equity-backed investments or purchases, any pediatrician approached by a hospital for partnership or acquisition should review PMI's guide to ensure they ask the right questions and assess whether the opportunity aligns with their needs, the needs of their practice, and the well- being of their patients.

The Pediatric Management Institute (PMI) offers a comprehensive range of advisory services tailored to assist pediatricians in reviewing and developing succession plans for their medical practices. PMI specializes in addressing the unique needs and challenges faced by pediatric healthcare providers. Here is a summary of the services provided by PMI:

They work closely with practice owners to identify potential successors, whether they are associates, or external candidates.

This helps in setting fair and realistic expectations for both buyers and sellers.

This includes evaluating revenue, expenses, and profitability.

and Development

and Governance

and Team Building