Practice Valuation Services

For years, practices have traditionally relied on their accountants to assess the value of their practice. While this method can provide certain advantages, it can also result in some misleading conclusions. Some accountants determine the practice’s value by calculating the "book value" (Assets minus Liabilities) and taking into account the partner/ shareholder's total earnings. However, it is important to acknowledge that the unique circumstances of a pediatric practice requires an approach that thoroughly understands the intricacies of their operations and financial performance.

The situation becomes even more complex when considering the relatively substantial cash flow within a typical pediatric practice. Recently, PMI encountered a client with eight pediatricians generating an annual revenue of over $4,000,000, and their attorney claimed that the practice was “worth millions” based on the revenue stream. However, upon closer examination of the numbers and analyzing the true financial performance of the practice, it became evident that the lawyer's assertion was incorrect.

What Is The Process?

1. The practice provides a few specific financial reports.

2. The practice sends the information to PMI via a secure link

3. Once all the needed information is received, PMI will review the information submitted and run a preliminary calculation

4. PMI will review the preliminary calculation with the practice and solicit feedback related to any assumptions made in the preliminary calculation

5. PMI will adjust, as needed, and submit the final valuation to the practice.

Schedule Your Complimentary Practice Valuation Consultation

Learn more about Practice Valuations

Below is a recent video from PMI showing how valuations are conducted along with the slides for the presentation.

Everything You Need To Know About Practice Valuations

The value of a practice can vary significantly depending on the buyer or investor involved. There are three main categories to consider:

-

This involves an "internal" buy-in or buy-out scenario where a pediatrician becomes a new partner/shareholder in the practice or an existing pediatrician wishes to retire and sell their interest in the practice to the remaining partners/shareholders.

-

Valuations in such cases generally tend to be lower compared to those offered by private equity-backed investments. Various factors come into play, including the practice's cultural expectations regarding profits and their distribution of profits.

-

These organizations have actively pursued opportunities to acquire pediatric practices in recent years.

-

Private equity-backed firms have their own set of advantages and disadvantages, and careful evaluation on a case-by-case basis is crucial to ensure compatibility with the practice's culture and expected future financial performance.

-

Valuations in these situations focus on Earnings Before Interest, Taxes, & Amortization (EBITA), often resulting in higher pediatric practice valuations thanks to commonly accepted financial models. For instance, if a practice's estimated EBITA is $200,000, a private equity-backed firm may be willing to pay several multiples of that amount, potentially ranging from 5 to 7 times EBITDA, or even higher in rare cases.

-

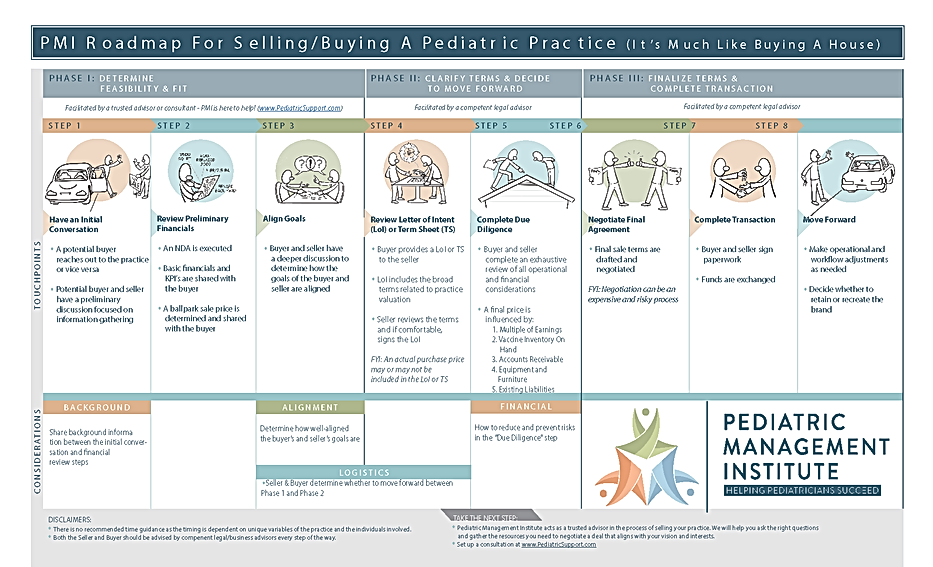

Additional complexities arise with private equity-backed investments, such as long-term plans, future employment contracts, non-compete covenants, and operational issues. PMI's published "Roadmap For Buying/Selling A Pediatric Practice" is recommended as a resource to help practices navigate such opportunities effectively.

-

Hospitals are no longer as willing to pay substantial amounts to acquire practices due to concerns regarding the costs outweighing the revenue from referrals.

-

Except for innovative joint-venture arrangements, hospitals are limited by Federal Stark laws, which restrict the amount they can pay to avoid any appearance of inducing referrals to the hospital's services.

-

Similar to private equity-backed investments or purchases, any pediatrician approached by a hospital for partnership or acquisition should review PMI's guide to ensure they ask the right questions and assess whether the opportunity aligns with their needs, the needs of their practice, and the well- being of their patients.

How Businesses Are Normally Valued

Here are the five most common ways to value a "regular" business:

-

Discounted Cash Flow (DCF) Analysis

-

Estimates future cash flows and discounts them back to the present using a required rate of return.

-

Example: A business is projected to generate $1 million in free cash flows over the next 5 years. Discounted at a 10% rate, the present value of those cash flows is $750,000.

-

-

Multiple of Earnings

-

Applies a multiple to a business's earnings to derive a value. Common earnings multiples include P/E, EV/EBITDA.

-

Example: A business has EBITDA of $2 million. An 8x multiple yields a valuation of $16 million ($2 million x 8).

-

-

Asset-Based Approach

-

Totals the net value of a business's tangible assets to determine an asset-based value.

-

Example: A business has $5 million in assets and $2 million in liabilities. Its asset-based value is $3 million ($5 million - $2 million).

-

-

Market Comparison

-

Compares the subject company to similar publicly traded companies or previous transactions.

-

Example: A business is valued by comparing EV/EBITDA multiples to 5 similar public companies. The average multiple of those companies is used.

-

-

Rule-of-Thumb Benchmark

-

Applies an industry-specific rule-of-thumb multiple to a business metric.

-

Example: A SaaS company is valued at 5x recurring revenue. If recurring revenue is $10 million, value is $50 million.

-

How Medical Practices Are Typically Valued

Normally, there are several valuation methods used together to determine the value of a medical practice, given the nuances and intricacies involved. The values from each approach may then be blended, with different weighting percentages based on relevance. This blended multi-method valuation aims to account for the specific attributes of the practice being valued.

Net Tangible Asset Valuation Method

The Net Tangible Asset Valuation Method values a business based on the tangible assets it owns minus its liabilities. Here's an overview and example:

How it works:

-

Identify all tangible assets - This includes things like cash, accounts receivable, inventory, real estate, equipment, etc. Intangible assets like goodwill and patents are excluded.

-

Determine the fair market value of the tangible assets - Tangible assets are assigned a fair market value based on what they could be liquidated for.

-

Add up the fair market values of all tangible assets - This results in the gross tangible asset value.

-

Subtract all liabilities - This includes debt, accounts payable, loans, etc. The remainder is the net tangible asset value.

Example:

-

A company has:

-

Cash: $100,000

-

Accounts Receivable: $250,000

-

Inventory: $500,000

-

Equipment: $1,000,000

-

Total Liabilities: $700,000

-

-

The fair market value of its tangible assets is $1.5 million.

-

Subtracting its $700,000 in liabilities results in a net tangible asset value of $800,000.

This $800,000 net tangible asset value represents what the business is worth from an asset-based perspective. This method is most applicable to asset-heavy businesses like manufacturers and retailers.

Capitalization Of Earnings Method

The Capitalization Of Earnings Method values a business by dividing its earnings by a capitalization rate. Here's an overview and example:

How it works:

-

Determine a business's normalized annual earnings - This is usually based on net income or seller's discretionary earnings from the past 1-2 years.

-

Select an appropriate capitalization rate - Lower rates typically between 5-20% are used for high-growth potential companies. More mature companies use higher rates of 20-40%.

-

Divide earnings by the capitalization rate - This yields the capitalized value of the business.

Example:

-

A retail store has averaged $200,000 in net profit over the past 2 years.

-

An appropriate capitalization rate is determined to be 20% given the company's maturity and growth prospects.

-

Dividing the $200,000 average earnings by the 20% capitalization rate equals a capitalized value of $1,000,000.

In this example, the capitalization of earnings method yielded a valuation of $1 million for the retail store based on its $200,000 in normalized earnings capitalized at a 20% rate. The capitalization rate is key in determining an accurate valuation.

Guideline Merged And Acquired Company Method

The Guideline Merged And Acquired Company Method values a business based on valuations from comparable acquisitions. Here's an overview and example:

How it works:

-

Identify comparable acquisitions - Find companies in the same industry, size range, growth rate, etc. that were recently acquired.

-

Determine the valuation multiples - Calculate multiples like price/revenue, price/EBITDA from the acquisition prices and financials.

-

Apply multiples to the subject company - Select applicable multiples based on comparability and apply them to the financial metrics of the company being valued.

-

Derive valuation estimate - Use the applied multiples valuation approaches to estimate a valuation range.

Example:

-

A medical device company (Company X) is being valued.

-

3 comparable medical device firms were acquired for 8x revenue and 12x EBITDA.

-

Company X has $5M in revenue and $1M EBITDA.

-

Applying the 8x revenue multiple yields a $40M valuation for Company X.

-

Applying the 12x EBITDA multiple yields a $12M valuation.

-

A valuation range of $12M-$40M is estimated based on comparable acquisitions. The final valuation depends on the comparability between the companies.

This method provides a useful indicator of value based on real acquisition pricing. The key is identifying truly comparable transactions.

Goodwill Registry Method

The Goodwill Registry Method values a business based on an estimate of its goodwill. Here's an overview and an example:

How it works:

-

Estimate the tangible asset value of the business using methods like book value or substantial value.

-

Estimate the total value of the business using methods like discounted cash flow or market approaches.

-

Subtract the tangible asset value from the total business value.

-

The remainder is the goodwill value. Apply an appropriate goodwill percentage to derive the valuation.

Example:

-

A retail business has $500,000 in tangible assets on its books.

-

Using a market approach, the total value of the business is estimated at $1.5 million.

-

Subtracting the tangible assets of $500,000 from the total $1.5 million valuation yields an estimated goodwill of $1 million.

-

Research indicates a 25% goodwill factor is typical for retail businesses.

-

Applying 25% to the $1 million in estimated goodwill results in a final valuation of $250,000 for the retail business.

This method is best used as a supplemental approach in conjunction with other valuation methods. The goodwill percentage/factor is subjective but is based on industry standards and deals with high intangible value.

PMI's Approach & Methodology For Pediatric Practices

PMI employs a distinct methodology to ascertain the value of a practice by assessing the financial advantage gained from practice ownership in contrast to being an employed pediatrician. To illustrate this, let's consider an example: if a partner/shareholder earns $250,000 in a given year, while an employed physician in the same practice, with a similar level of productivity, earns approximately $180,000, the additional benefit derived from owning the practice totals $70,000. This $70,000 figure represents the closest approximation to demonstrate the "benefit of owning a practice."

Just like stock prices in companies such as Apple, Chevron, and Microsoft are determined based on projected earnings over a span of 10-15 years, PMI follows a conservative approach when valuing pediatric practices, utilizing a multiple of earnings below two (2). This conservative valuation approach is influenced by various factors including:

-

Limited pool of potential buyers interested in investing in a particular practice (typically, non-providers are unable to purchase medical practices).

-

Existence and enforceability of non-compete agreements.

-

Strength and transition of management, among other considerations.

During the valuation process, PMI initially calculates the value by applying a multiple of 1 - 2 times the projected earnings after accounting for a partner/shareholder’s base salary. This projected value is then combined with the total assets and outstanding liabilities reported in the practice's financial records. Referring back to the previous example where the benefit of practice ownership amounted to $70,000, typically PMI multiplies this figure by 1.5 years, resulting in $105,000. This amount is then added to the balance of the practice's assets and liabilities.

Accounts Receivables

The accounts receivables represent one of the most substantial, if not the largest, assets of a practice. These accounts receivables denote the amount the practice is awaiting as payment for services rendered. However, for a practice with a reported overall balance of $300,000 on the accounts receivable report, it is unlikely that they can, will, or should expect to receive the full amount. This discrepancy arises from the difference between the practice's service charges and the contracted rates they have agreed upon with managed care plans, Medicaid, etc.

To obtain a more accurate estimate of the expected payment for the reported $300,000 balance, some calculations are necessary. For instance, if the practice's gross collection rate (total payments divided by total charges) for the past year is 50%, one should anticipate receiving less than half of the reported $300,000 in their practice's bank account at some point in the future. PMI's valuation services take this a step further by incorporating additional adjustments based on the age of various balances (e.g., less than 30 days, 31-60 days, over 60 days, etc.). These adjustments further enhance the precision of predicting the actual amount to be received.

Frequency of Valuation

How frequently should a practice determine its value? The answer is "every year." PMI recommends that pediatric practices adopt a framework or formula to calculate their practice's value and update the numbers annually. Typically, this update occurs in April, as most practices have filed their tax returns for the previous year, and the financial figures are the most up-to-date as of December 31.

Assume we are in the month of April 2023. The practice would calculate the value of their practice as of December 31, 2022. Any transactions that take place in 2023 would be based on the value determined as of December 31, 2022, with a few adjustments for the value of accounts receivables and vaccine inventory. This proactive approach offers several benefits:

-

Retirement Planning: Partners/shareholders can plan for their future retirement by knowing the potential amount they may receive upon retirement.

-

Risk Mitigation: The practice can be aware of its value before unexpected adverse events such as death, disability, or a partner's divorce. By predefining the anticipated value in advance, many potentially contentious issues can be avoided, preventing them from arising during emotionally charged situations.

-

Insurance Planning: The practice can purchase the appropriate amount of life insurance to fund an unexpected buyout resulting from the death of a partner/shareholder.

-

Cash Flow Management: The practice can plan its cash flow in situations where a partner/shareholder announces their intention to retire.

-

Recruitment Advantage: Can assist in recruitment of pediatricians to independent pediatric practices by being able to share with a prospective hire a realistic expectation of his/her long term plans.

Similar to the well-established recommendation of having a will to express final wishes, pediatric practices must prioritize establishing a clear commitment to defining expectations regarding all financial matters when a partner/shareholder departs or joins the practice.

One Big Caveat

A significant majority of the pediatric practices PMI works with utilize some type of valuation method that determines the value based on a pre- agreed formula outlined in their partnership or shareholder agreement. In many cases, the value of one's ownership interest is represented by a nominal amount, typically ranging from $50,000 to $75,000. Under this approach, the practice's leadership follows the philosophy that this specified amount represents the investment to access the practice's profits.

For instance, let's consider Dr. Smith, who has been an employed physician at the practice for the past three years and desires an equity position. In order to obtain this position, Dr. Smith agrees to pay $50,000 for a pro-rated share of the profits. When she eventually leaves the practice, she will receive her initial investment of $50,000 back, along with a percentage of her accounts receivables collected within 90 days after her buyout. While there is no “perfect” model to address all issues of fairness (perceived or real), it is generally the practice’s culture that greatly influences the framework and viability of such an approach.

In some cases, practices adopt an "eat what you kill" approach, where revenue and expenses are meticulously allocated based on individual contributions. On the other hand, other practices may favor a more "socialist" method, distributing profits evenly among all stakeholders regardless of individual productivity. Both of these examples come with their own set of challenges that necessitate a high level of expertise to navigate and minimize unintended consequences that could jeopardize the practice's future viability.

PMI offers extensive expertise in consulting for numerous pediatric practices across the United States, providing support and guidance in adopting an approach that strives for fairness for all parties involved while simultaneously ensuring the practice's long-term financial sustainability.

Formula For Internal Buy In/Out

If the practice consists of multiple shareholders and one or more employed physicians, the valuation process is relatively straightforward. Here's an outline of the steps involved:

-

Determine the average earnings of the shareholders.

-

Compare the shareholder earnings with the average compensation of employed physicians within your practice. If all physicians are shareholders, you can refer to regional or national averages for comparison. Multiply the difference (variance) by the number of shareholders to establish the Valuation Basis.

-

Multiply the Valuation Basis by the projected number of years of earnings (1 – 2 years).

In addition to the core formula, there are several adjustments that may need to be considered, such as:

-

Incorporating the average shareholder salary from the previous two or three years.

-

Change(s) for any federal stimulus funds received during the pandemic as well as any “one-off” events affecting the practice’s financial condition.

-

Modifying the Average Shareholder Compensation if shareholders have previously taken lower salaries to finance practice projects expected to generate additional future earnings.

-

Accounting for upcoming significant capital expenditures by adjusting the Years of Projected Earnings or Average Shareholder Compensation.

-

Addressing various nuances within the shareholder compensation formula.

The process of determining the value of a pediatric practice involves various intricate factors that need to be carefully considered. While some pediatricians may opt for a do-it-yourself (DIY) approach, it is crucial to recognize that assessing the value entails more than simply inputting numbers into a spreadsheet. It requires a deep understanding of the interplay between the partner/shareholder compensation formula, the practice culture, and the methodology used to determine the practice's value. Given the complexities involved, it is vital for the practice to engage competent advisors who can provide guidance and assistance throughout this endeavor.

Other Shareholder Concerns

Be sure to check out our previously posted article about the Common Issues Overlooked In Shareholder Agreements found here.

Need Some Help With A Practice Valuation?

Our standard practice valuation package is $2,750 and includes:

1. Initial consultation with the practice representative;

2. Review of financial data and calculation of practice value;

3. Follow-up discussion with practice representative to review how the valuation was determined.

PMI also provides mediation services between partners to act as a third-party and resolve concerns individually with each shareholder during this process.